| 2. | Approval of the amendment to the Company’s Articles of Incorporation to increase the authorized number of shares of the Company’s common stock to 70,000,000 shares from 20,000,000 shares (Proposal No. 2). |

| 3. | Approval of the Company’s reincorporation from California to Delaware (Proposal No. 3). |

| 4. | Approval of the First Foundation Inc. 2015 Equity Incentive Plan (Proposal No. 4). |

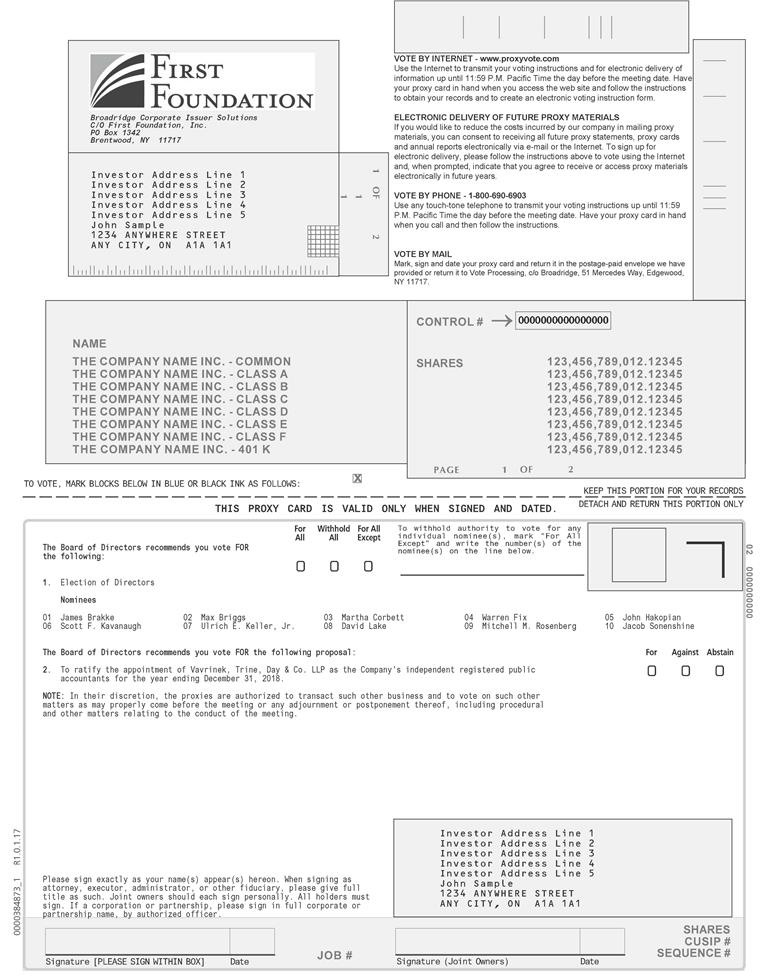

| 5. | Ratification of the appointment of Vavrinek Trine Day & Co. LLP as the Company’s independent registered public accounting firm for fiscal year 2015 (Proposal2018 (Proposal No. 5)2). |

| 6. | Approval of the adjournment or postponement of the Annual Meeting, if necessary to solicit additional proxies in favor of one or more of the foregoing proposals (Proposal No. 6). |

If any other matter should be presented at the Annual Meeting upon which a vote may properly be taken, the shares represented by your proxy will be voted in accordance with the judgment of the holders of the proxy. However, if your shares are held in a brokerage account or by a nominee, please read the information above under the caption “Votingsubsection entitled “Voting Shares Held by Brokers, Banks and Other Nominee Holders”Holders” regarding how your shares may be voted. What is the Vote Required to Approve the Proposals that will be Voted on at the Annual Meeting? Quorum Requirement. Our Bylaws require that a quorum — that is, the holders of a majority of all of the shares entitled to vote at the Annual Meeting — be present, either in person or by proxy, before any business may be transacted at the Annual Meeting (other than adjourning the Annual Meeting to a later date to allow time to obtain additional proxies to satisfy the quorum requirement). Proposal No. 1. Election of Directors. A plurality of the votes cast is required for theThe election of directors. This means thatdirector nominees requires the 10 nominees for election to the Board who receive the highest number of votes cast will be elected. As a result, any shares voted to “Withhold Authority” and any broker non-votes (which are described below) will not have any effect on the outcome of the election. However, shares voted to “Withhold Authority” and broker non-votes are considered present at the meeting for purposes of determining whether a quorum is present. Proposal No. 2. Approval of Amendment to the Company’s Articles of Incorporation to Increase the Authorized Number of Shares of Common Stock to 70,000,000 Shares from 20,000,000 Shares. The affirmative vote of the holders of a majority of the Company’s outstanding shares of common stock is required to approve this Proposal. As a result, abstentions and broker non-votes will the same effect as a vote “against” this Proposal.

Proposal No. 3. Approval of the Company’s Reincorporation from California to Delaware. The affirmative vote of the holders of a majority of the Company’s outstanding shares of common stock is required to approve this Proposal. As a result, abstentions and broker non-votes will the same effect as votes “against” this Proposal.

Proposal No. 4. Approval of the Company’s 2015 Equity Incentive Plan. The affirmative vote of a majority of the votes cast with respect to such director in an uncontested election (meaning the number of shares voted “for” a nominee must exceed the number of common stockshares voted “against” such nominee). If the Corporate Secretary of the Company determines that the number of director nominees exceeds the number of director nominees to be elected as of the record date for the Annual Meeting, the director nominees will be elected by vote of a plurality of the shares, present in person or represented by proxy and voting atentitled to vote on the annual meeting is requiredelection of directors. In such event, the ten director nominees receiving the greatest numbers of votes “for” will be elected as directors without regard to approve this Proposal. Asthe number of shares voted against such director nominees. Votes cast shall include votes “for” and “against” a result, broker non-votes willnominee and exclude “abstentions” and “broker non-votes” with respect to that nominee’s election. A director who does not affect the outcomereceive a majority of the vote on this Proposal.votes cast in an uncontested election must tender an offer of resignation to the Board of Directors. The Nominating and Corporate Governance Committee will consider the resignation offer and make a recommendation to the Board of Directors whether to accept or reject the resignation or whether other action should be taken. If any such director’s resignation offer is not accepted by the Board of Directors, the Board of Directors will publicly disclose its decision, including the reasons for not accepting the resignation offer, within four business days after reaching its decision.

Proposal No. 5.2. Ratification of Appointment of Vavrinek, Trine, Day & Co., LLP as the Company’s independent registered public accounting firm for fiscal year 20152018. The affirmative vote of a majority of the shares of common stock present in person or represented by proxy and voting at the Annual Meeting is required to approve this Proposal. As a result, broker non-votes will not affect the outcome of the vote on this Proposal.

3

Proposal No. 6. Approval of the Adjournment or Postponement of the Annual Meeting. The affirmative vote of a majority of the shares of common stock present in person or represented by proxy and voting at the Annual Meeting is required to approve this Proposal. As a result, broker non-votes will not affect the outcome of the vote on this Proposal.

What are Broker Non-Votes and How Will They Affect the Voting at the Annual Meeting? Under rules applicable to securities brokerage firms, a broker who holds your shares in “street name” does not have the authority to vote those shares on any “non-routine” proposal, except in accordance with voting instructions received from you. On the other hand, your broker may vote your shares on certain “routine” proposals (such as the ratification of the appointment of independent registered public accountants), if the broker has transmitted proxy-soliciting materials to you, as the beneficial owner of the shares, but has not received voting instructions from you on such proposals. If the broker does not receive voting instructions from you, but chooses to vote your shares on a routine matter, then your shares will be deemed to be present by proxy and will count toward a quorum at the Annual Meeting, but will not be counted as having been voted on, and as a result will be deemed to constitute “broker non-votes” with respect to, non-routine proposals which, at this year’s Annual Meeting, will consist of: the Election of Directors (Proposal No. 1), the approval of the Share Increase Amendment (Proposal No. 2), the approval of the Reincorporation Proposal (Proposal No. 3) and the approval of the 2015 Equity Incentive Plan Proposal (Proposal No. 4). We will treat broker non-votes as follows: Broker non-votes will have the same effect as a vote “against” a proposal if approval of the proposal requires the affirmative vote of the holders of a majority of the outstanding shares, and will be counted as present for quorum purposes. Broker non-votes will not be counted as having been voted, and will not affect the outcome of the voting, on approval of the 2015 Equity Incentive Proposal and on any routine proposal which, to be approved, requires the affirmative vote of the holders of a majority of the shares voted on the proposal, but broker non-votes will be counted as present for quorum purposes.

How Can I Revoke My Proxy and Change My Vote? If you are a registered owner and have given us your proxy (whether by mail, by telephone or over the Internet), you may change your vote by taking any of the following actions: Sending a written notice to us that you are revoking your proxy, addressed to the Secretary of the Company, at 18101 Von Karman Avenue, Suite 700, Irvine, California 92612, and then voting again by one of the methods described immediately below. To be effective, the notice of revocation must be received by the Company before the Annual Meeting commences. If, however, after sending us a written notice of revocation, you fail to vote your shares by eitherany of the following two methods, then none of your shares can be voted at the Annual Meeting. Sending us another proxy, by mail, dated at a later date than your earlier proxy. However, to be effective, that later-dated proxy must be received by the Company before the Annual Meeting commences and must be dated and signed by you. If you fail to date or fail to sign that later-dated proxy, it will not be treated as a revocation of an earlier-dated proxy and your shares will be voted in accordance with your earlier voting instructions. Attending the Annual Meeting and voting in person in a manner that is different than the voting instructions contained in your earlier proxy or voting instructions. If you submitted your proxy by telephone or over the Internet, you may change your vote or revoke your proxy with a later telephone or Internet proxy, as the case may be. However, if your shares are held by a broker or by a bank or other nominee holder, you will need to contact your broker, bank or nominee holder if you wish to revoke your earlier voting instructions.

4

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT Set forth below is information regarding the beneficial ownership, as of September 14, 2015,July 18, 2018, of the Company’s common stock by (i) each person who we knew owned, beneficially, more than 5% of the Company’s outstanding shares, (ii) each of the Company’s directors and each nominee standing for election to the Board at the Annual Meeting, (iii) each of the current executive officers of the Company who are named in the Summary Compensation Table below, and (iv) all of the directors and executive officers as a group. As of September 14, 2015,July 18, 2018, a total of 15,960,46444,397,035 shares of our common stock were issued and outstanding. | | | | As of September 14, 2015(1) | | | As of July 18, 2018 (1) | | Name and Title | | Number of

Shares

Beneficially

Owned(2) | | Percent of

Class | | | Number of

Shares

Beneficially

Owned (3) | | | Percent of

Class | | Wellington Management Company, LLP | | | 1,485,000 | | | 9.3 | % | | 280 Congress Street | | | | | | Boston, MA 02210 | | | | | | | | | | | | | | | | FMR LLC | | | 3,148,020 | (2) | | 7.1 | % | Ulrich Keller, Jr., Executive Chairman | | | 1,396,085 | (3) | | 8.7 | % | | 2,541,170 | (4) | | 5.7 | % | Scott Kavanaugh, Vice Chairman and CEO | | | 689,467 | | | 4.3 | % | | 1,378,661 | | | 3.1 | % | James Brakke, Director | | | 62,761 | | | * | | | 131,580 | | | * | | Max Briggs, Director | | | 30,958 | (4) | | * | | | 37,308 | (5) | | * | | Victoria Collins, Director | | | 407,810 | (5) | | 2.5 | % | | Martha Corbett, Director | | | 825 | | | * | | Warren Fix, Director | | | 82,218 | (6) | | * | | | 127,494 | (6) | | * | | John Hakopian, Director and President of FFA | | | 485,180 | | | 3.0 | % | | 939,560 | | | 2.1 | % | Gerald Larsen, Director | | | 21,401 | | | * | | | David Lake, Director | | | 133,715 | | | * | | Mitchell M. Rosenberg, Director | | | 33,701 | | | * | | | 58,460 | | | * | | Jacob Sonenshine, Director | | | 40,201 | | | * | | | 59,292 | | | * | | David S. DePillo | | | 344,785 | | | 2.2 | % | | 709,203 | | | 1.6 | % | John Michel | | | 144,000 | | | * | | | 180,961 | | | * | | All Directors and executive officers as a Group (12 persons) | | | 3,738,567 | | | 22.4 | % | | Robert Nobel | | | 107,843 | | | * | | All Directors and executive officers as a Group (11 persons) | | | 6,406,072 | | | 14.3 | % |

(1) | This table is based upon information supplied to us by our officers, directors and principal shareholders.stockholders. Except as otherwise noted, we believe that each of the shareholdersstockholders named in the table has sole voting and investment power with respect to all shares of common stock shown as to which he or she is shown to be the beneficial owner, subject to applicable community property laws. The percentage ownership interest of each individual or group is based upon the total number of shares of the Company’s common stock outstanding plus the shares which the respective individual or group has the right to acquire within 60 days after September 14, 2015July 18, 2018 through the exercise of stock options or pursuant to any contract.contract or any other arrangement. |

(2) | The ownership information set forth in the table is based on information contained in a statement on Schedule 13F, filed with the SEC by FMR LLC as of March 31, 2018. FMR LLC’s address is 245 Summer Street, Boston , Massachusetts, 02210. |

| (3) | Includes shares that may be acquired within 60 days of September 14, 2015July 18, 2018 pursuant to the exercise of stock options, as follows: Mr. Keller—95,000110,000 shares; Mr. Kavanaugh—260,000180,000 shares; Messrs. Brakke, Fix, Sonenshine and Dr. Rosenberg,—16,5003,000 shares each; Dr. Collins—45,500Mr. Hakopian—100,000 shares; Mr. Hakopian—90,500 shares; Mr. Briggs—15,000 shares; Mr. Larsen—11,000 shares; Mr. Michel—127,00094,000 shares; and all of the directors and executive officers as a group—710,500493,000 shares. |

(3)(4) | Includes 100,000200,000 shares beneficially owned by Mr. Keller’s wife, as to which he disclaims beneficial ownership. |

(4)(5) | Includes 3,0006,000 shares beneficially owned by Mr. Briggs’ wife, as to which he disclaims beneficial ownership. |

(5)(6) | Includes 8,121 shares beneficially owned by Dr. Collins’ husband, as to which she disclaims beneficial ownership. |

(6) | Includes 5,90011,800 shares beneficially owned by Mr. Fix’s wife, as to which he disclaims beneficial ownership. |

5

ELECTION OF DIRECTORS (Proposal No. 1) The Company’s Bylaws provide that the authorized numberBoard of Directors maywill consist of one or more members, which will be any number within a rangedetermined from time to time by resolution of 7 and 13, inclusive, with the exact number within that range to be set by the Board of Directors. The Board of Directors has set the authorized number of Directorsdirectors at 10.ten. Accordingly, a total of 10 Directorsten directors will be elected at the Annual Meeting to hold office until the next annual shareholders’stockholders’ meeting and until their respective successors are elected and qualify to serve. The Board of Directors has nominated for election the 10ten persons named in the table below, all of whom are incumbent Directors.directors. Each of the nominees has consented to serve as a Directordirector if elected at the Annual Meeting. Unless authority to vote has been withheld, the named proxy holders intend to vote the shares represented by the proxies received by them “FOR”“FOR” the election of all of those 10ten nominees. If, prior to the Annual Meeting, any of the Board of Director’s nominees becomes unable to serve, the Board of Directors either will designate a substitute nominee, in which event the proxy holders will vote the proxies received by them for his or her election, or will reduce the authorized number of directors standing for election. Vote Required and Recommendation of the Board of Directors Under California law,The election of director nominees requires the 10 nominees receivingaffirmative vote of a majority of the highestvotes cast with respect to such director in an uncontested election (meaning the number of votes cast by holdersshares voted “for” a nominee must exceed the number of shares voted “against” such nominee). If the secretary of the Company’s common stock votedCompany determines that the number of director nominees exceeds the number of director nominees to be elected as of the record date for the Annual Meeting, the director nominees will be elected by vote of a plurality of the shares, present in person or by proxy atand entitled to vote on the Annual Meetingelection of directors. In such event, the nine director nominees receiving the greatest numbers of votes “for” will be elected as directors without regard to serve as the Directorsnumber of shares voted against such director nominees. Votes cast shall include votes “for” and “against” a nominee and exclude “abstentions” and “broker non-votes” with respect to that nominee’s election. A director who does not receive a majority of the Company untilvotes cast in an uncontested election must tender an offer of resignation to the next annual shareholders’ meetingBoard of Directors. The Nominating and until their respective successors are electedCorporate Governance Committee will consider the resignation offer and have qualifiedmake a recommendation to serve. As a result, although shares asthe Board of Directors whether to whichaccept or reject the authority to voteresignation or whether other action should be taken. If any such director’s resignation offer is withheld will be counted, they will have no practical effect onnot accepted by the outcomeBoard of the election of Directors.

If, prior to voting, any record shareholder announces at the Annual Meeting an intention to cumulate votes in the election of the Directors, the proxy holders named onBoard of Directors will publicly disclose its decision, including the enclosed proxy card will havereasons for not accepting the discretionary authority to allocate and cast the votes represented by the proxies they hold among the nominees named below as to whom authority to vote has not been withheld in such proportions as they deem appropriate in order to elect as many of those nominees as is possible.resignation offer, within four business days after reaching its decision.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERSSTOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES NAMED BELOW. Nominees Set forth below is the name, age and position with the Company of each of the nominees recommended by the Nominating and Corporate Governance Committee and selected by the Board of Directors to stand for election to the Board at the Annual Meeting. All of the nominees named below, other than Ms. Corbett and Mr. Lake, were elected to the Board by the shareholdersstockholders at last year’s annual meeting. The business address for all of these nominees is 18101 Von Karman Avenue, Suite 700, Irvine, California 92612. | | | | | | | Name | | Age | | Director

Since | | Positions with FFI | | | | | Ulrich E. Keller, Jr., CFP | | 58 | | 2007 | | Executive Chairman and Director | | | | | Scott F. Kavanaugh | | 54 | | 2007 | | Chief Executive Officer, Vice Chairman and Director | | | | | James Brakke | | 73 | | 2007 | | Director | | | | | Max Briggs, CFP | | 50 | | 2012 | | Director | | | | | Victoria Collins, Ph.D., | | 72 | | 2007 | | Director | | | | | Warren D. Fix, CPA | | 77 | | 2007 | | Director | | | | | John Hakopian | | 47 | | 2007 | | Director, President of FFA | | | | | Gerald Larsen | | 66 | | 2013 | | Director | | | | | Mitchell M. Rosenberg, Ph.D | | 61 | | 2007 | | Director | | | | | Coby Sonenshine, J.D., CFA | | 44 | | 2007 | | Director |

Name | | Age | | Director

Since | | Positions with FFI | | | | | Ulrich E. Keller, Jr., CFP | | 61 | | 2007 | | Executive Chairman and Director | | | | | Scott F. Kavanaugh | | 57 | | 2007 | | Chief Executive Officer, Vice Chairman and Director | | | | | James Brakke | | 76 | | 2007 | | Director | | | | | Max Briggs, CFP | | 53 | | 2012 | | Director | | | | | Martha Corbett | | 57 | | 2018 | | Director | | | | | Warren D. Fix, CPA | | 80 | | 2007 | | Director | | | | | John Hakopian | | 50 | | 2007 | | Director, President of FFA | | | | | David Lake | | 52 | | 2018 | | Director | | | | | Mitchell M. Rosenberg, Ph.D | | 64 | | 2007 | | Director | | | | | Jacob Sonenshine, J.D., CFA | | 47 | | 2007 | | Director | | | | |

6

Seven of the Company’s 10ten directors have been determined by the Board to be independent directors, because they have not been employed nor have they received any compensation from the Company or any of its subsidiaries during the past three years, other than compensation for their service on the Board and on Board Committees.committees of the Board. Those directors are Dr. CollinsMs. Corbett, and Messrs. Brakke, Briggs, Fix, Larsen,Lake, Rosenberg and Sonenshine. Set forth below is a summary of the business experience and qualifications of the nominees named above who are standing for election to the Board at the Annual Meeting.

Ulrich Keller, Jr., CFP. Mr. Keller is one of the founders of the Company and currently is the Executive Chairman of FFI and its wholly-owned subsidiary, First Foundation Advisors (“FFA”).FFA. Mr. Keller served as Chief Executive Officer (“CEO”) of FFA from 1990, when it began operations as a fee-only investment advisor, until December 2009, at which time he became its Executive Chairman. In 2007, Mr. Keller became the Executive Chairman of FFI and from June 2007 until December 2009 he also served as the CEO of FFI. Mr. Keller earned a Bachelor of Science degree in Finance from San Diego State University and completed the financial planning program at the University of Southern California. Mr. Keller servesserved as a memberTrustee of the University of California Irvine (“UCI”) Foundation’sfor 15 years. During that time he was Chair of the Foundation Finance & Investment Committee and servescontinues to serve as a member of the Investment Committee. Mr. Keller served as Co-Chair for the Center for Investment and Wealth Management at the Paul Merage School of Business at UCI. As one of the founders of the Company, who played a key role in the development and successful implementation of our business strategy of providing high quality and personalized wealth management and investment advisory services to our clients and the expansion of the financial services we offer our clients, Mr. Keller brings to the Board considerable knowledge and valuable insights about the wealth management and investment advisory business and the Southern California financial services market. Scott Kavanaugh. Mr. Kavanaugh is, and since December 2009 has been the CEO of FFI, and from June 2007 until December 2009, he served as President and Chief Operating Officer of FFI. Mr. Kavanaugh has been the Vice- Chairman of FFI since June 2007. He also is, and since September 2007 has been, the Chairman and CEO of FFI’s wholly-owned banking subsidiary, First Foundation Bank (“FFB”). Mr. Kavanaugh was a founding shareholder and served as an Executive Vice President and Chief Administrative Officer and a member of the board of directors of Commercial Capital Bancorp, Inc., the parent holding company of Commercial Capital Bank. During his tenure as an executive officer and director of Commercial Capital Bancorp, Inc. that company became a publicly traded company, listed on NASDAQ, and its total assets grew to more than $1.7 billion. From 1998 until 2003, Mr. Kavanaugh served as the Executive Vice President and Chief Operating Officer and a director of Commercial Capital Mortgage. From 1993 to 1998, Mr. Kavanaugh was a partner and head of trading for fixed income and equity securities at Great Pacific Securities, Inc., a west coast-based regional securities firm. Mr. Kavanaugh earned a Bachelor of Science degree in Business Administration and Accounting at the University of Tennessee and a Masters of Business Administration (“MBA”) degree in Information Systems at North Texas State University. Mr. Kavanaugh is, and since 2008 has been, a member of the board of directors of Colorado Federal Savings Bank and its parent holding company, Silver Queen Financial Services, Inc. Since March 2015, Mr. Kavanaugh has served as director for Nexpoint Residential Trust Inc., a publicly traded real estate investment trust that is advised by NexPoint Real Estate Advisors, L.P. an affiliate of Highland Capital Management, L.P.. Mr. Kavanaugh also is, and since December 2013 has been,served as a member of the boards of directors of NexBank SSB and its parent holding company, NexBank Capital, Inc. from December 2013 until December 2015. From January 2000 until June 2012, Mr. Kavanaugh served as Independent Trustee and Chairman of the Audit Committee, and from June 2012 until December 2013 served as Chairman, of the Highland Mutual Funds, a mutual fund group managed by Highland Capital Management.Management, L.P.. The Board believes that Mr. Kavanaugh’s extensive experience as an executive officer of banks and other financial services organizations, combined with his experience as a director of both public and private companies, qualifies him to serve as a member of our Board of Directors. In addition, because Mr. Kavanaugh is the Company’s Chief Executive Officer, the Board of Directors believesCEO, we believe that his participation as a member of the Board facilitates communication between the outside Board members and management. James Brakke. Mr. Brakke has served as a director of FFI since 2007. From 2001 until 2006 Mr. Brakke served as a director of Commercial Capital Bancorp, Inc. and from 2000 until 2006, Mr. Brakke served as a director of Commercial Capital Bank. Mr. Brakke is, and since 2001 has been, Executive Vice President and director of the Dealer Protection Group, an insurance brokerage firm that Mr. Brakke co-founded, which specializes in providing insurance products to the automobile industry. Mr. Brakke also serves as a salesperson for Brakke-Schafnitz Insurance Brokers, a commercial insurance brokerage and consulting firm that he co-founded and where he was President and Chairman from 1971 until 2009. Mr. Brakke currently serves as a director of Maury Microwave Corporation, as a director of Debt Resolve, Inc and as Chairman of Advanced Wellness and Lasers. Mr. Brakke earned a Bachelor of Science degree in Business and Finance from Colorado State University. Mr. Brakke’s experience as a director of Commercial Capital Bancorp, Inc. and its wholly owned banking subsidiary, Commercial Capital Bank is valuable to other independent member of the Company’s 7

Board of Directors. Moreover, we believe Mr. Brakke’s extensive knowledge of the insurance industry provides valuable insight and support for our insurance operations. Max Briggs, CFP. From 2005 to 2012, Mr. Briggs served as Chairman of the Board of DCB.Desert Commercial Bank (“DCB”). He was elected as a director of the Company following our acquisition of DCB in August 2012. Mr. Briggs is, and since 1996 has been the President and CEO of FLC Capital Advisors, a wealth management firm with over $300$400 million of assets under management.administration. From 1992 to 2007, Mr. Briggs served as CEO of Franklin Loan Center, a mortgage banking company. Mr. Briggs earned a Business Administration and Finance degree from Stetson University. We believe Mr. Briggs is a valuable member of our Board of Directors due to his knowledge of the banking business, gained from his service as Chairman of DCB, particularly as conducted in Palm Desert, California and its surrounding communities, where we have two of our wealth management offices, and his experience as President and CEO of a wealth management firm. Victoria Collins, Ph.D. Dr. Collins is andMartha Corbett. Ms. Corbett has beenserved as a director of FFI since 2007. BeginningFebruary 27, 2018. Ms. Corbett retired from PricewaterhouseCoopers LLP in 1990, Dr. CollinsJune 2016 after more than 32 years in a wide range of client service and leadership roles in the firm. She was previously a partner in the firm’s Advisory practice which includes the firm’s consulting, deals and forensic businesses and was a member of the Global Advisory Leadership Team. Ms. Corbett has served as an executive officeron the Board of FFA, including as an Executive Vice President from 1990 until 2009Directors of Children’s Hospital Los Angeles since 2008 and as a Senior Managing Director from 2009, until her retirement in December 2011. Dr. Collins currently serves onas the Dean’s Advisory Board forChair of the Center for Investment and Wealth Management at the Paul Merage School of Business at the University of California, Irvine. Dr. Collins earned a Bachelor’s of Administration degree in Psychology from San Diego State University, a Master of Arts degree in Educational Psychology from St. Mary’s College and a Doctor of Philosophy (“Ph.D.”) degree in Cognitive Psychology from the University of California, Berkeley. Dr. Collins’ found that her knowledge of psychology was invaluable in her role as an executive officer and a senior wealth manager at FFA.Audit Committee. We believe that the Board has found that Dr. CollinsMs. Corbett brings to the Board valuable insights about FFA’s business from her knowledge of accounting, governance, risk oversight and strategy resulting from her experience in wealth management,long tenure and client experiences with public companies at PwC and through her management experience at FFA.significant non-profit board roles.

Warren Fix. Mr. Fix has served as a director of FFI since 2007. Mr. Fix is, and since 1992 has been, a partner in The Contrarian Group, a business investment and management company. From 1995 to 2008, Mr. Fix served in various management capacities and on the Board of Directors of WCH, Inc., formerly Candlewood Hotel Company. From 1989 to 1992, Mr. Fix served as President of the Pacific Company, a real estate investment and development company. From 1964 to 1989, Mr. Fix held numerous positions at the Irvine Company, including serving as its Chief Financial Officer (“CFO”) and as a director.member of the executive committee of the board of directors. Mr. Fix currently serves as a director of

Healthcare Trust of America, a publicly traded real estate investment trust and Clark Investment Group, Accel Networks and CT Realty.Group. Mr. Fix earned a Bachelor of Administration degree from Claremont McKenna College. We believe Mr. Fix brings to the Board his knowledge of accounting, real estate and financial matters as a result of his long tenure as CFO of the Irvine Company and his experience as an independent director of both public and private companies. John Hakopian. Mr. Hakopian is, and since April 2009 has been, the President of FFA and is and since 2007 has been a member of the Company’s Board of Directors. Mr. Hakopian was one of the founders of FFA in 1990, when it began its operations as a fee-based investment advisor and served as its Executive Vice President and Co-Portfolio Manager from 1994 through April 2009. Mr. Hakopian earned a Bachelor of Arts degree in Economics from UCI and a MBA degree in Finance from the University of Southern California. Mr. Hakopian’s extensive knowledge of the Company’s wealth management and investment advisory business makes him a valuable member of the Board who is able to provide the outside Board members with insight in to the operations and risks of that business. Gerald Larsen, J.D, LL.M, CFP, CPADavid Lake. Mr. LarsenLake has served as a director of FFI since 2013June 1, 2018. Since 1993 Mr. Lake has been the Chief Executive Officer of and as a directorco-founder of FFB since 2008.4EARTH Farms, Inc. Mr. Larsen is, and since 1992 hasLake served as the President, Principal and ownerChairman of the law firmBoard of Larsen & Risley, locatedDirectors of PBB Bancorp, since its formation in Costa Mesa, California. Mr. Larsen’s law practice focuses on federalMay, 2014, and state taxation, probate, estate planning, partnerships and corporate law. Mr. Larsen earned a Bachelor of Science degree in Accountingthe Board of Directors of its wholly-owned subsidiary Premier Business Bank from California State University, Northridge, a Juris Doctorate degree fromJuly 2006 until the law school at Stetson University, in Florida, and an LL.M. degree fromJune 2018 acquisition of PBB Bancorp by the University of Florida.Company. We believe that Mr. Larsen’s extensiveLake brings to the Board his knowledge of operating a highly successful company and his experience as an independent director of a tax and estate planning lawyer provides the Board with valuable insights regarding the tax and estate planning aspects of wealth management.community bank in Southern California.

Mitchell Rosenberg, Ph.D.Dr. Rosenberg has served as a director of FFI since 2007. Dr. Rosenberg is, and since 2005 has served as, President and founder of the consulting firm of M. M. Rosenberg & Associates, which provides executive and organizational development services to technologypublic and private companies in the fields of financial services, health care businesses and public entities.technology. From 2002 to 2005, Dr. Rosenberg was Chief Executive Officer for The Picerne Group, an international investment firm investing primarily in real estate, and portfolios of loans. Prior to 2002, Dr. Rosenberg served as Executive Vice President and Director of Business Services for Ameriquest Capital Corporation and directed the 8

Human Resource and Organizational Development functions for Washington Mutual Bank, American Savings Bank and Great Western Bank. Dr. Rosenberg earned a Bachelor of Science degree in Psychology from Ohio University, a Masters of Science degree in Industrial Psychology from California State University, Long Beach, and a Ph.D. degree in Psychology with an emphasis on Organizational Behavior from Claremont Graduate University, which is the graduate university of the Claremont Colleges. We believe that Dr. Rosenberg’s educational and operational experience in managing the human resource and organizational development functions of a number of banking organizations and a real estate investment firm provides insight regarding the Company’s human resource functions, including compensation considerations that will impact the Company’s growth and expansion. Jacob Sonenshine, J.D., CFA. Mr. Sonenshine has served as a director of FFI since 2007. Mr. Sonenshine is, and since 2012, has served as co-chief executive officerPresident of Prell Restaurant Group, an operator of fast casual restaurants. From 2006 until 2012, Mr. Sonenshine served as the President and Chief Operating Officer of ProfessionalProfessionals Retirement Strategy, a retirement planning and entity risk management firm. From 1999 to 2005, Mr. Sonenshine was President and co-founder of RSM EquiCo, an investment bank specializing in mergers and acquisitions of privately-held middle market companies. Mr. Sonenshine currently serves on the Board of New Momentum, LLC, a software firm focusing on brand protection, anti-counterfeiting and channel integrity. Mr. Sonenshine earned a Bachelor of Science degree in economics and a Bachelor of Administration degree in International Relations from the University of Pennsylvania, and a J.D. degree and a MBA degree from the University of Southern California. We believe Mr. Sonenshine’s experience as CEOPresident of a retirement planning firm is valuable to the Board in overseeing FFA’s wealth management and investment advisory business. There are no family relationships among any of the Company’s directors or executive officers.

Executive Officers In addition to Messrs. Keller, Kavanaugh and Hakopian, each of whom is an executive officer and an incumbent Directordirector and nominee for re-election to the Board of Directors at the Annual Meeting, set forth below are the names and biographical information of our other executive officers: David S. DePillo. Mr. DePillo, age 54, is, and since May 2015 has been, the President of FFB. Mr. DePillo has more than 25 years of banking and investment management experience. He was most recently at Umpqua Bank, where he served as Executive Vice President from April 2014, following Umpqua’s acquisition of Sterling Savings Bank, until he left to join FFB. He joined Sterling Savings Bank in October 2010 as its chief credit officerChief Credit Officer and transitioned to chief lending officerChief Lending Officer in March 2012, until his appointment as Executive Vice President of Umpqua Bank. Previously, Mr. DePillo served as the vice chairmanVice Chairman of the board of Fremont General Corporation, a financial services holding company, and of Fremont Investment & Loan, its wholly-owned bank subsidiary. From November 2007 to September 2009, he was the president of both companies. From 1999 through 2006, Mr. DePillo served as the vice chairman, presidentVice Chairman, President and chief operating officerChief Operating Officer of Commercial Capital Bancorp Inc. and its subsidiary companies. John Michel. Mr. Michel, age 56, is, and since September 2007 has been, the Executive Vice President and CFO of the Company and FFB. Since January 2009, he has also served as the CFO of FFA. Mr. Michel served as the Chief Financial OfficerCFO of Sunwest Bank from February 2005 to October 2006 and of Fidelity Federal Bank from September 1998 to December 2001. Mr. Michel earned a Bachelor of Business Administration Accounting degree from the University of Notre Dame. Robert Noble. Mr. Noble, is, and since June 2015 has been, the Executive Vice Present, Chief Lending Officer of FFB. Mr. Noble has over 25 years of banking experience. He was most recently at Umpqua Bank, where he served as Executive Vice President, Income Property Lending Executive from April 2014, following Umpqua's acquisition of Sterling Savings Bank, until he left to join FFB. He joined Sterling Savings Bank in January 2011, also serving as Executive Vice President, Income Property Lending Executive. Prior to joining Sterling, Mr. Noble provided

consulting services to Sterling and prior to that provided consulting services to Fremont Reorganizing Corporation from 2008 to 2010. Mr. Noble served as Executive Vice President, Commercial Real Estate Lending for Countrywide Bank from 2006 to 2008. From 1999 to 2006, Mr. Noble served as Executive Vice President, Director of Asset Quality for Commercial Capital Bank. There are no family relationships between any director, executive officer or person nominated to become a director or executive officer. The Board of Directors Election of Directors Our bylaws provide that our directors are toshall be elected at each annual meeting of shareholdersstockholders but, if any such annual meeting is not held or the directors are not elected at an annual meeting,thereat, the directors may be elected at any special meeting of shareholdersstockholders held for thatsuch purpose. All directors shall hold office until their respective successors are elected, subject to applicable California lawthe Delaware General Corporation Law (the “DGCL”) and the provisions of our bylaws with respect to vacancies on the Board.Board of Directors. A vacancy on the Board of Directors shall be deemed to exist (i) in case of the death, resignation, retirement, disqualification, or the removal (with or without cause) of any director, (iii) if a director has been declared of unsound mind by order of court or convicted of a felony, (iii) if the authorized number of directors is increased, or (iv) if the shareholders fail, at any annual or special 9

meeting of shareholders at which any director or directors are elected, to elect the full authorized number of directors to be voted for at that meeting.

from office. Vacancies on the Board of Directors, other than a vacancy createdunless otherwise required by law or by resolution of the removalBoard of a director,Directors, may be filled only by a majority vote of the remaining directors then in office, though less than a quorum or, if there is only one director then in office, by a sole remainingsuch director (and in neither case by the stockholders). No decrease in the number of authorized directors shall shorten the term of any incumbent director. Subject to the DGCL and our bylaws, each director soshall be elected shall hold office until his or her successor is elected at the next annual or a special meeting of the shareholders called for the purpose of electing directors. A vacancy on the Board of Directors created by the removal of a director may only be filled by the vote of athe majority of the shares entitledvotes cast with respect to vote representedthe director at a duly heldany meeting for the election of the shareholdersdirectors at which a quorum is present, or byprovided, however, that at any meeting of stockholders for which the written consentsecretary of the holdersCompany determines that the number of a majoritynominees exceeds the number to be elected as of the outstanding shares.record date for such meeting, the directors shall be elected by vote of the plurality of the shares, present in person or represented by proxy and entitled to vote on the election of directors. Role of the Board of Directors In accordance with CaliforniaDelaware law, the Board of Directors oversees the management of the business and affairs of the Company. The members of the Board of Directors keep informed about our business primarily through discussions with management, by reviewing analyses and reports sent to them by management and outside consultants, and by participating in Board and in Board committee meetings. Our Board members are encouraged to prepare for and to attend all meetings of the Board and the Board committees of which they are members and all meetings of our shareholders. During the fiscal year ended December 31, 2014, the Board of Directors of the Company held a total of 11 meetings and each of the directors attended at least 90% of the total of those meetings and the meetings of the Board committees on which he or she served during 2014, except for Dr. Collins who attended more than 70% of total of those 11 Board meetings and the meetings of the Board committees on which she served during 2014. All of our directors also attended the 2014 Annual Meeting of Shareholders. Although we have no formal policy requiring director attendance at annual meetings of shareholders, we attempt to schedule each annual meeting for a date that is convenient for all directors to attend.

The Board’s Role in Risk Oversight The Board’s responsibilities in overseeing the Company’s management and business include oversight of the Company’s key risks and management processes and controls. Management, in turn, is responsible for the day-to-day management of risk and implementation of appropriate risk management controls and procedures. The risk of incurring losses on the loans we make is an inherent feature of the banking business and, if not effectively managed, such risks can materially affect our results of operations. Accordingly, the Board, as a whole, exercises oversight responsibility over the processes that our management employs to manage those risks. The Board fulfills that oversight responsibility by: monitoring trends in the Company’s loan portfolio and the Company’s allowance for loan losses; establishing internal limits related to the Company’s lending exposure and reviewing and determining whether or not to approve loans in amounts exceeding certain specified limits; reviewing and discussing, at least quarterly and more frequently, asif the Board may deem to bedeems necessary, reports from the FFB’s chief credit officer relating to such matters as (i) risks in the Company’s loan portfolio, (ii) economic conditions or trends that could reasonably be expected to affect (positively or negatively) the performance of the loan portfolio or require increases in the allowance for loan losses,ALLL and (iii) specific loans that have been classified as “special mention,” “substandard” or “doubtful” and, therefore, require increased attention from management; reviewing, at least quarterly, management’s determinations with respect to the adequacy of, and any provisions required to be made to replenish or increase, the allowance for loan losses;ALLL; reviewing management reports regarding collection efforts with respect to nonperforming loans; and authorizing the retention of, and reviewing the reports of, external loan review consultants with respect to the risks in and the quality of the loan portfolio. 10

Although risk oversight permeates many elements of the work of the full Board and its committees, the audit committeeAudit Committee is responsible for overseeing any other significant risk management processes.

Committees of our Board of Directors Our Board of Directors has three standing committees: an audit committee,Audit Committee, a compensation committeeCompensation Committee, and a nominatingNominating and governance committee.Corporate Governance Committee. The Board of Directors has adopted a written charter for each of those committees, and copies of those charters are available inon the investor relationsInvestor Relations section of our website at: http://investor.ff-inc.com.at www.ff-inc.com. In addition, from time to time, special committees may be established under the direction of our Board of Directors when necessary to address specific issues. The Audit Committee. Committee. The Board of Directors has established a standing audit committee,Audit Committee, the members of which are Mr. Fix, its chairman, and Messrs. Briggs and Larsen.Sonenshine and Ms. Corbett. The Board of Directors has determined that all of the members of the audit committeeAudit Committee are independent within the meaning of the Listing Rules of the NASDAQ Stock Market and the enhanced independence requirements for audit committee members contained in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our Board of Directors also has determined that each of Messrs. Fix and Briggs meetsand Ms. Corbett meet the definition of “audit committee financial expert” adopted by the Securities and Exchange Commission (the “SEC”(‘SEC”). The audit committee held five meetings in 2014. The audit committee’sAudit Committee’s responsibilities include: Selectingoverseeing the integrity of the financial statements of the Company and appointingits subsidiaries, including the financial reporting processes and systems of internal controls regarding finance, accounting, legal and regulatory compliance;

overseeing the independence, qualifications and performance of the Company’s independent auditors followingand internal audit function; monitoring the committee’s evaluation of their qualifications, preapproving the services to be rendered by them, and determining the fees to be paidopen communication among the independent auditors for their services to the Company; overseeing the work of and monitoring and evaluating the independent auditors’ performance and independence and making all decisions with respect to the termination of the independent auditors;

reviewing all audit and non-audit services to be performed by the independent auditors, taking into consideration whether the provision of any non-audit services by the independent auditors is compatible with maintaining their independence;

reviewing and discussing withauditor, management, and the independent auditors the annual and quarterly financial statements prior to their release;

reviewing and discussing with management and our independent auditors the adequacy and effectiveness of our accounting and financial reporting processes and internal controls and the audits of our financial statements;

establishing and overseeing procedures for the receipt, retention and treatment of any complaints that may be received by us regarding accounting, internal accounting controls or auditing matters, including procedures for the confidential and anonymous submission by our employees of questions or concerns regarding accounting or auditing matters;

investigating any matter brought to the audit committee’s attention within the scope of its duties and engaging independent counsel and other advisors as the audit committee deems necessary for that purpose;

reviewing reports to management prepared by the internal audit function as well as management’s responses to those reports;and the Board of Directors;

reviewing and assessing the adequacy of the committee’sits formal written charter on an annual basis; and reviewing and deciding whether or not to approve any related party transactions in accordance with the Company’s related party transaction policy; and

overseeing such other matters that may be specifically delegated to the audit committeeAudit Committee by ourthe Board of Directors. The Audit Committee met eight times during 2017. 11

The Compensation Committee.Committee. The Board of Directors has established a standing compensation committee,Compensation Committee, the members of which are Dr. Rosenberg, its chairman, and Messrs.Mr. Brakke and Larsen.Ms. Corbett. The Board of Directors has determined that all of the members of the compensation committeeCompensation Committee are independent within the meaning of the NASDAQ rules applicable to such committees. The compensation committee held two meetings in 2014. The compensation committee’sCompensation Committee’s responsibilities include: reviewing and approving the compensation plans, policies and programs for the Company’s CEO and other senior officers; developing, reviewing and approving our management compensation programs and reportingmaking recommendations to the full Board of Directors regardingwith respect to the adoption or revision of cash and effectiveness of such programs, including cash bonus and cash incentive plans and programs; and

equity incentive plans, and programs; approving individual grants or awards under cash and equity incentive compensation plansthereunder and reporting to the full Board of Directors regarding the terms of such individual grants or awards; reviewing and approving individual and Company performance goals and objectives that must be achieved for executive officers to earn any performance-contingent cash or equity incentive awards; reviewing and approvingdiscussing with the terms of any employment agreement, severance or change in control arrangements, or other compensatory arrangement with any executive officers or other key management employees;

reviewing withCompany’s management the narrative discussion and tables regarding executive officer and director compensation to be included in the Company’s annual proxy statementsstatement, in accordance with respectapplicable laws, rules and regulations;

producing and approving an annual report on executive compensation for inclusion in the Company’s annual proxy statement, in accordance with applicable laws, rules and regulations; making recommendations to executive officerthe Board of Directors regarding the type and director compensation;amount of compensation be paid or awarded to members of the Board of Directors; reviewing and assessing on an annual basis, the adequacy of its formal written charter;charter on an annual basis; and overseeing any other matters that may be specifically delegated to the compensation committeeCompensation Committee by ourthe Board of Directors. The Compensation Committee met two times during 2017.

The Nominating and Corporate Governance Committee. The Board of Directors has established a standing nominatingNominating and governance committee,Corporate Governance Committee, the members of which are Dr. Rosenberg, its chairman, and Messrs. Briggs and Sonenshine. The Board of Directors has determined that all of the members of the nominatingNominating and governance committeeCorporate Governance Committee are independent within the meaning of the NASDAQ rules applicable to such committees. The nominating and governance committee held one meeting in 2014. The nominatingNominating and governance committee’sCorporate Governance Committee’s responsibilities include: identifyingdeveloping and recommending nominees for electionpolicies to the Board of Directors;Directors regarding the director nomination process, including establishing a policy with regard to consideration of director candidates recommended by directors, employees, stockholders and others or to fill director vacancies, in accordance with the Company’s bylaws;

identifying and making recommendations to the Board of Directors regardingspecific candidates for election as directors; recommending to the Board of Directors specific selection qualifications and criteria for Board membership; evaluating the independence of the directors and making recommendations to the Board of Directors with respect to the directors to be appointed to serve on each committee of its standing committees; developing and recommending corporate governance guidelines for adoption by the Board of Directors;

developing and recommending, for the Board of Director’s approval, corporate governance principles and policies, and codes of conduct for the Company’s executive officers, employees and directors as the Committee determines from time to time to be appropriate, in accordance with applicable laws, rules and regulations; overseeingleading the Board of Directors in its annual self-assessments by the directorsreview of the performance of the Board of Directors and its committees.committees, as applicable;

reviewing and assessing the adequacy of its formal written charter on an annual basis; and overseeing any other matters that may be specifically delegated to the Nominating and Corporate Governance Committee by the Board of Directors. The Nominating and Corporate Governance Committee met four times during 2017. Corporate Governance Principles and Policies Our Directors believeBoard believes that sound governance policies and practices provide an important framework to assist them in fulfilling their duties to the Company’s shareholders.stockholders. Our Board of Directors has adopted the following governance guidelines, which include a number of policies and practices under which our Board has operated for some time, together with concepts suggested by various authorities in corporate governance and the requirements under applicable NASDAQ rules. Our Board members believe these policies and practices are essential to the performance of the Board’s oversight responsibilities and to the maintenance of the Company’s integrity in the marketplace. 12

Some of the principal subjects covered by those guidelines include: Codes of Business and Ethical Conduct. Our Board of Directors hasWe have adopted a Code of Business and Ethical Conduct for our directors, officers and employees and a Code of Conduct which contains specific ethical policies and principles that apply to our Chief Executive Officer, Chief Financial Officer FFB’s President and other key accounting and financial personnel. A copy of eachour Code of these codesConduct is accessible at the Investor Relations section of our website athttp://ff-inc.com. www.ff-inc.com. We intend to disclose, at that same location on our website, any amendments to and any waivers of the requirements of the Code of Business and Ethical Conduct that may be granted to our Chief Executive Officer, or Chief Financial Officer.Officer or other key accounting and financial personnel. Incentive Compensation Clawback Policy. Our Board of Directors has adopted an Incentive Compensation Clawback Policy. Under that Policy, if any of our executive officers receive incentive compensation as a result of our achievement of financial results measured on the basis of financial statements that are required to be restated, we will become entitled to recoup from those executive officers the amount by which the incentive compensation they had received based on those financial statements exceeds the incentive compensation they would have received had such incentive compensation been determined on the basis of the restated financial statements (“excess compensation”). The Policy further provides that, if the excess compensation was paid or received in shares of common stock and the officer had sold those shares within a year of the public disclosure of the financial statements that were the subject of the accounting restatement, we will be entitled to recoup the net profits realized by the officer from the sale of those shares. Related Party Transaction Policy. Our Board of Directors has adopted a Related Party Transaction Policy, which provides that, subject to certain limited exceptions, the Company will not enter into or consummate a related party transaction that is determined by the Audit Committee to be materially less favorable from a financial standpoint to the Company than similar transactions between the Company and unaffiliated third parties. Board Leadership Structure. The Chairman of our Board of Directors is RickUlrich E. Keller, Jr., who is a member of senior management, and our Chief Executive Officer is Scott Kavanaugh. The Board of Directors decided to separate the positions of Chairman and Chief Executive Officer because the boardBoard of Directors believes that doing so provides the appropriate leadership structure for us at this time, particularly since the separation of those two positions enables our Chief Executive Officer to focus on the management of our business and the development and implementation of strategic initiatives, while the Chairman leads the board of directorsour Board in the performance of its responsibilities.

Director Independence and Diversity. SEC rules impose several requirements with respect toOur Board of Directors has evaluated the independence of our directors. Our nominatingits members based on the definition of independence for purpose of Board membership and governance committee andmembership on the Board’s standing committees that are applicable to the Company because its shares are listed on the NASDAQ Stock Market. Based on that evaluation, our Board of Directors have evaluatedhas concluded that (i) seven members of the independenceBoard are independent: Ms. Corbett and Messrs. Brakke, Briggs, Fix, Lake, Rosenberg and Sonenshine; and (ii) all of the members of the Board, the Audit Committee, and the Compensation Committee based upon those rules and on the independence standards adopted by the NASDAQ Stock Market which, among other things, require that a board be comprised of at least a majority of independent directors. Our Board of Directors has affirmatively determined that 7 of our 10 directorsNominating and Corporate Governance Committee are independent within the meaning of those rules and standards. independent. The Board of Directors believes that differences in experience, knowledge, skills and viewpoints enhance the Board of Directors’ performance. Accordingly, the nominatingNominating and governance committeeCorporate Governance Committee considers such diversity in selecting, evaluating and recommending proposed Board nominees. However, the Board of Directors has not implemented a formal policy with respect to the consideration of diversity for the composition of the Board of Directors. Director Responsibilities. Directors are expected to act in the best interests of all shareholders;stockholders; develop and maintain a sound understanding of our business and the industry in which we operate; prepare for and attend Board and Board committee meetings; and provide active, objective and constructive participation at those meetings. Director Access to Management. Directors will have access to members of management and members of management will provide Board presentations and reports regarding the functional areas of our business for which they are responsible. 13

Adequate Funding for the Board and its Committees. The Company will provide the funding necessary to enable the Board of Directors and each of its committees to retain independent advisors as the Board of Directors, or such committees acting independently of the full Board of Directors, deem to be necessary or appropriate. Executive Sessions without Management. The independent directors of the Board will hold separate sessions, outside the presence of management, to consider and evaluate the performance of the Company and its management and such other matters as they deem appropriate. In addition, the Audit Committee shall meet separately with the Company’s outside auditors. Communications with the Board of Directors. ShareholdersStockholders and other interested persons may communicate with the full Board of Directors, any Board committee, the independent directors as a group or any individual member of the Board in writing by mail addressed to the Corporate Secretary, First Foundation Inc. 18101 Von Karman Avenue, Suite 700, Irvine CA, 92612. All communications will be forwarded to the Board of Directors, the particular committee of the Board or the specified directors or individual director, as appropriate. The Company screens all regular mail for security purposes. Selection and Nomination of Candidates for Election to the Board of Directors We believe that our directors should have the highest professional and personal ethics and values, consistent with our longstanding values and standards. They should have broad experience at the policy-making level in business, banking or government or established academic credentials and achievements in fields relevant to our businesses. They should be committed to enhancing shareholderstockholder value and must represent the interests of all shareholdersstockholders as opposed to any particular constituency within our shareholders.stockholders. Directors also should have sufficient time to carry out their duties and to provide insight and practical wisdom, based on their experience, to management. Therefore, their service on boards of other companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly their duties as directors of the Company. The nominatingNominating and governance committeeCorporate Governance Committee recommends to the Board for selection as Board nominees persons who the members of that committee believe are best qualified to serve on the Board.Board of Directors. That committee will consider director candidates recommended by shareholders,stockholders, other members of the Board of Directors, officers and employees of the Company and other sources that the committee deems appropriate. Under its charter, the committeeNominating and Corporate Governance Committee also has the authority to engage an executive search firm and other advisors as it deems appropriate to assist it in identifying qualified Board candidates. The nominatingNominating and governance committeeCorporate Governance Committee charter directs the committee to evaluate the candidates based upon the totality of their merits and not based upon minimum qualifications or attributes. In considering individual director candidates, the committeeNominating and Corporate Governance Committee takes into account the qualifications and business experience of the other members of the Board to ensure that a broad variety of skill sets and experience beneficial to the Company and its businesses are represented on the Board of Directors. The nominatingNominating and governance committeeCorporate Governance Committee evaluates all director candidates in the same manner regardless of the source of the recommendation. The committeeNominating and Corporate Governance Committee will interview and, when deemed appropriate, will conduct background inquiries about, Board candidates. Some of the criteria used by the committeeNominating and Corporate Governance Committee to evaluate the candidates, including those selected for nomination at the 20152018 Annual Meeting, include: personal and professional integrity; independence;

absence of conflicts of interest; prior business experience or academic achievements and credentials, including knowledge of the banking business; educational record and achievements; skills that may be relevant to the Company’s business; prior board experience with the Company or other publicly traded companies; and

| • | prior board experience with the Company or other publicly traded companies; and |

involvement in community, business and civic affairs. ShareholderStockholder Recommendation of Board Candidates. Any shareholderstockholder desiring to submit a recommendation for consideration by the nominatingNominating and governance committeeCorporate Governance Committee of a candidate for election to the Board may do so by submitting that recommendation in writing to the Board not later than 120 days prior to the first anniversary of the date on

14

which the proxy materials for the prior year’s annual meeting were first sent to shareholders.stockholders. However, if the date of an annual meeting has been changed by more than 30 days from the anniversary date of the prior year’s annual meeting, the recommendation must be received within a reasonable time before the Company begins to print and mail its proxy materials for that annual meeting. In addition, the recommendation should be accompanied by the following information: (i) the name and address of the nominating shareholderstockholder and the person that the nominating shareholderstockholder is recommending for consideration as a candidate for Board membership; (ii) the number of shares of voting stock of the Company that are owned by the nominating shareholder,stockholder, his or her recommended candidate and any other shareholdersstockholders known by the nominating shareholderstockholder to be supporting the nomination of that candidate; (iii) a description of any arrangements or understandings that relate to the election of directors of the Company, between the nominating shareholder,stockholder, or any person that (directly or indirectly through one or more intermediaries) controls, or is controlled by, or is under common control with, such shareholder,stockholder, on the one hand, and the person that the nominating shareholderstockholder is recommending for election to the Board or any other person or persons (naming each such person), on the other hand; (iv) such other information regarding the recommended candidate as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC; and (v) the written consent of the recommended candidate to be named as a nominee and, if nominated and elected, to serve as a director. The Board and the nominatingNominating and governance committeeCorporate Governance Committee make no distinction between whether a candidate is recommended by a shareholderstockholder or by management and the Board and the nominatingNominating and governance committeeCorporate Governance Committee apply the same process and criteria in evaluating a candidate recommended by a shareholderstockholder as it would for a candidate recommended by management. ShareholderStockholder Nominations. Our Bylawsbylaws provide that any record shareholder alsostockholder may nominate, at any annual meeting of shareholders,stockholders, one or more candidates for election to the Board of Directors, by giving the Company written notice (addressed to the Corporate Secretary of the Company at the Company’s principal offices) of such shareholder’sstockholder’s intention to do so not laterless than 90 days nor more than 120 days prior to the first anniversary of the date on which the Company’s proxy materialsstatement for the prior year’s annual meeting werewas first sentreleased to shareholders. If,stockholders, provided however, that in the event that no annual meeting was held in that prior year or the date of the annual meeting has been changed by more than 30 calendar days from the first anniversary ofdate contemplated at the datetime of the prior year’s meeting, then suchproxy statement, to be timely, the stockholder notice must have beenbe received not later thanby the close of business on the tenthlater of (i) the 90th day prior to such annual meeting, or (ii) the 10th day following the daydate on which a public announcement of the date of such annual meeting is made.first mailed or is first publicly announces. Such notice must be accompanied by the samestatements and other information described in the immediately preceding paragraph, regarding each such candidateCompany’s Bylaws, including the following items:

The nominating stockholder's name, address, and beneficial ownership of shares of the Company (and the same information with respect to any beneficial owner for which the nominating stockholder is acting on behalf of); The name, age, business address, residential address, and principal occupation or employment of the person to be nominated for election to the Board and the nominating shareholder and the writtennominated; The nominee's signed consent of such candidate to be named as a nominee and, if nominated and elected, to serve as a director. Shareholdersdirector of the Company, if elected; The number of shares of the Company's stock beneficially owned by the nominee; A description of all arrangements and understandings between the stockholder and the nominee pursuant to which the nomination is to be made; and Such other information concerning the director nominee as would be required in a proxy statement soliciting proxies for the election of the director nominee under the rules of the SEC. Stockholders are advised to carefully review our Bylaws,bylaws, which contain a description of the information required to be submitted, as well as the advance notice and other requirements that apply to nominations by shareholdersstockholders of candidates for election to the Board. Any shareholderstockholder nomination at any annual meeting that does not comply with these Bylawthe requirements set forth in our bylaws will be ineffective and disregarded. Section 16(a) Beneficial Ownership Reporting Compliance Pursuant to Section 16(a) of the Exchange Act requires each ofand the related rules and regulations, our directors and executive officers and any person who may ownbeneficial owners of more than 10% of any registered class of our common stock (a “10% Shareholder”),equity securities, are required to file reports with the SEC containing information regarding such person’sof their ownership, and any changes in the ownership, of our shares of common stock and of options, warrants or any other rights to purchase shares of our common stock. Our directors and executive officers and any 10% Shareholders are required by SEC regulations to furnish us with copies of all forms that each has filed with the SEC pursuant to Section 16(a) of the Exchange Act. To our knowledge, based solely on a review of copies of Section 16(a) reports furnished to us and on written representations from such reporting persons, during 2014,2017, all of those persons complied with the Section 16(a) filing requirements, except for a Form 4 filed to report a purchase of 500 shares of the Company’s common stock by Warren Fix, which was inadvertently filed two (2) days late. requirements. 15

AMENDMENT OF THE COMPANY’S ARTICLES OF INCORPORATION

TO INCREASE THE AUTHORIZED NUMBER OF SHARES

OF COMMON STOCK TO 70,000,000 SHARES

(Proposal No. 2)

Article Three of the Company’s Articles of Incorporation, as amended (the “Articles of Incorporation”), currently authorizes the issuance, by Board action, of up to 20,000,000 million shares of our common stock, par value $0.001 per share, and up to 5,000,000 shares of our preferred stock, par value $0.001 per share. As of September 14, 2015, a total of 15,962,686 shares of common stock were issued and outstanding and a total of 1,686,786 shares of common stock were reserved for future issuance under the Company’s shareholder-approved equity incentive plans, leaving a total of just 2,350,528 shares of common stock available for sales of shares in the future.

The Board of Directors has approved, subject to shareholder approval, an amendment to Article Three of the Company’s Articles of Incorporation to increase the authorized number of shares of our common stock to 70,000,000 shares (the “Share Increase Amendment”). The authorized number of shares of preferred stock will remain unchanged at 5,000,000 shares.

The increase in the authorized number of shares of common stock is intended to ensure that the Company will continue to have an adequate number of authorized and unissued shares of common stock for future use. While the Company does not have any current intention to sell or issue the shares contemplated by the Share Increase Amendment, this amendment would give the Company the necessary flexibility to issue shares of common stock to raise additional capital to support the Company’s growth initiatives, for general corporate purposes, to use as consideration in business acquisitions, and pursuant to equity-based incentive compensation plans. Having such shares available for issuance in the future will enable us to issue and sell shares of common stock without the expense and delay of a shareholders meeting (except when shareholder approval is required under applicable law or NASDAQ rules). Among other things, any such delay could cause us to lose out on acquisition opportunities when we are competing for those acquisitions with other companies that do have available shares.

Additional shares of common stock authorized for issuance by the Share Increase Amendment, if and when issued, will have the same rights and privileges as the shares of common stock that are currently owned by our shareholders. Our common stock has no preemptive rights to purchase common stock or other securities. In addition, under California law, our shareholders are not entitled to dissenters’ or appraisal rights in connection with the proposed increase in the number of shares of common stock authorized for future issuance.

If the Share Increase Amendment is approved by our shareholders at the Annual Meeting, then, paragraph (a) of Article Three of the Articles of Incorporation will be amended and restated to read in its entirety as follows:

“(a) The total number of shares which the corporation shall have authority to issue is 75,000,000 shares, comprised of 70,000,000 shares of common stock, par value $0.001 per share, and 5,000,000 shares of preferred stock, par value $0.001 per share.”

The proposed increase in the number of authorized shares of the Company’s common stock will not, by itself, change the number of shares of common stock outstanding, nor will it have any immediate dilutive effect on the Company’s current shareholders. However, the issuance of additional shares of common stock authorized by the Share Increase Amendment may occur at times or under circumstances that could result in a dilutive effect on earnings per share, book value per share or the percentage voting or ownership interest of the present holders of the Company’s common stock, none of whom have preemptive rights to subscribe for additional shares that the Company may issue.

Although an increase in the number of authorized shares of the Company’s common stock could, under certain circumstances, also be construed as having an anti-takeover effect (for example, by permitting easier dilution of the stock ownership of a person seeking to effect a change in the composition of the Board of Directors or contemplating a tender offer or other transaction resulting in our acquisition by another company), the proposed increase in authorized shares and in authorized shares of common stock is not in response to any effort by any person or group to accumulate our common stock or to obtain control of us by any means. In addition, the proposal is not part of any plan by our Board of Directors to recommend or implement a series of anti-takeover measures.

16

If the Share Increase Amendment is approved by our shareholders, then, it will become effective upon filing of a Certificate of Amendment of the Articles of Incorporation of the Company with the California Secretary of State. However, if the shareholders also approve the reincorporation of the Company from California to Delaware (Proposal No. 3) at the Annual Meeting, then the Board of Directors may choose, instead, to give effect to the increase in the authorized number of shares, not by filing the Certificate of Amendment of Articles of Incorporation with the California Secretary of State, but by providing, in the Certificate of Incorporation to be filed in Delaware in connection with the reincorporation, that the Company’s authorized capital stock shall consist of 75,000,000 million shares, comprised of 70,000,000 shares of common stock, par value $0.001 per share, and 5,000,000 shares of preferred stock, par value $0.001 per share. Our shareholders will be deemed to have approved this method for effectuating the Share Increase Amendment if they approve both the Share Increase Amendment and the Reincorporation Proposal.

However, even if the Company’s shareholders approve the Share Increase Amendment, the Board retains the discretion under California law not to implement that Amendment. Nevertheless, the Board has no reason to expect that, if the Share Increase Amendment is approved by our shareholders, it would not implement that Amendment.

Vote Required for Approval and Board Recommendation

The affirmative vote of the majority of the outstanding shares of common stock entitled to vote on the Share Increase Amendment is required to amend the Articles of Incorporation to increase the authorized number of shares of common stock to 70,000,000 shares.

The Board unanimously recommends a vote “FOR” approval of the Share Increase Amendment

to increase the authorized number of shares of common stock from 20,000,000 shares to 70,000,000 shares.

17

REINCORPORATION OF THE COMPANY FROM CALIFORNIA TO DELAWARE

(Proposal No. 3)

Introduction

Our Board has unanimously approved a change in our state of incorporation from California to Delaware (the “Reincorporation”), subject to the approval of our shareholders. If approved, the Reincorporation will be effectuated pursuant to the terms of a merger agreement providing for us to merge into a newly formed wholly-owned subsidiary of the Company incorporated in the State of Delaware (“FFI-Delaware”). The name of the Company after the Reincorporation will remain First Foundation Inc. For purposes of the discussion below, the Company as it currently exists as a corporation organized under the laws of the State of California is sometimes referred to as “FFI-California” or as “we” or “us.”